Corporate tax filing

At SBQS Ltd., we specialize in business and corporate tax filing services in Calgary. Whether you’re a start-up or an established business, we understand the importance of timely tax filing and GST returns. We handle everything from personal to corporate taxes, ensuring accuracy and attention to detail. Our goal is to minimize your tax liability and maximize refunds, providing premium, affordable, and personalized service every step of the way.

The easiest way to file your taxes!

Please send your document by email, and we will take care of the rest!

The Importance of Filing Your Income Tax Return

Corporate tax filing involves preparing and submitting a corporation’s tax return to the relevant authorities. This process includes reporting income, deductions, and credits to determine the company’s tax liability. It ensures compliance with federal tax laws, prevents penalties, and promotes accurate financial reporting. Proper filing is essential for transparency and legal compliance.

At SBQS Ltd., our mission is to provide premium, affordable, and personalized service.

Checklist for corporate income tax filing:

Corporate Information

- Corporation year-end bank account balance

If this is the first year of corporation tax filing, please provide

- Corporation name

- Corporation Number

- Incorporation date

- Corporation address

- Corporation business number

- Corporation’s primary product or service

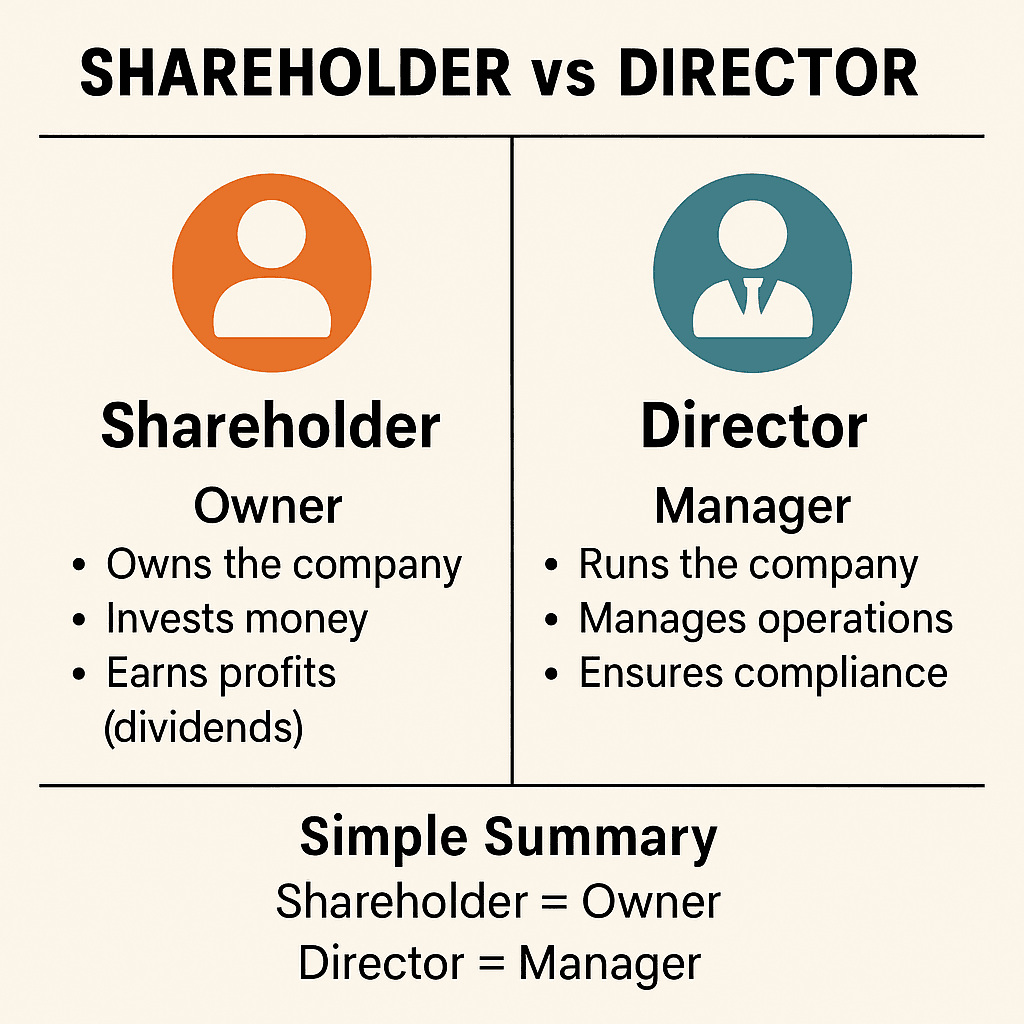

- Shareholders’ name, SIN, and percentage of share

- Director or President’s Name and Phone Number

If this corporation filed tax before, please provide

- Previous corporation tax return

Earnings for Corporations

- Gross Earnings for Corporate Entities

Business Expenditures for Corporations

- Advertising and promotion

- Business Insurance

- Business taxes, licences, and memberships

- Computer-related expenses

- Credit card charges

- Donations

- Franchise fees

- General and administrative expenses

- Home office expenses

- Interest and bank charges

- Meals and entertainment

- Office expenses

- Professional fees

- Purchase of materials

- Rental fees

Business Expenditures for Corporations

- Salaries and wages (attach T4)

- Shipping and warehouse expenses

- Subcontracts

- Supplies

- Telephone & Internet

- Training

- Travel expenses

- Vehicle expenses (kilometres driven to earn business income)

- Other expenses

- Dividend

- Shareholders’ Dividend (attach T5)

- Account R/P

- Account receivable

- Account payable

- Cost of Corporation Capital Assets

- Equipment

- Others